proposed federal estate tax changes 2021

Limit generation-skipping transfer trusts to a term of 50 years. 2021-2022 town of brookhaven 2021-2022 louis j.

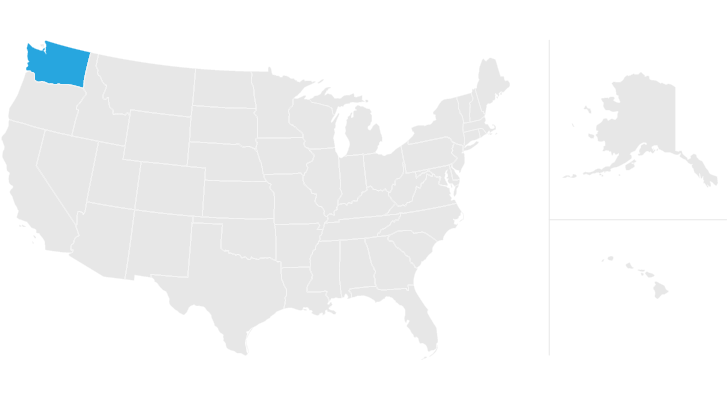

Washington Estate Tax Everything You Need To Know Smartasset

The exemption applies to total bequests and gifts separate from the annual inter-.

. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. It remains at 40. The top federal income tax rate for estates and non-grantor trusts would increase to 396.

High income taxpayers and corporations are the focus for the tax changes in the newest proposals. In addition the proposed bill provides that estates or trusts with income over 100000 would be subject to an additional 3 tax on their modified adjusted gross income. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

As a result of the proposed tax law changes families small business owners and others may want to take advantage of the current 117 million gift tax exemption before the end of 2021. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3 But it wouldnt be a surprise if the estate tax law changed as part of the overall plan.

Proposed Estate and Gift Tax Changes. Additionally these proposed tax rates would apply to taxable estates. Is 117 million in 2021.

The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on Dec. The taxable estate is taxed at 40. The maximum estate tax rate would increase from 39 to 65.

July 13 2021 The current 2021 gift and estate tax exemption is 117 million for each US. The exemption equivalent was significantly raised beginning January 1 2018 and the inflation adjusted amount for the 2021 year is. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

The Biden Administration has proposed significant changes to the income tax system. Here is what we know thats proposed. Conversely a new tax proposal under the Biden administration seeks to reduce the exclusion limit from 117 million or up to 234 million for married couples to 35 million or up to 7 million for married couples and increase the tax rate from 40.

Both Senators and Representatives have proposed increasing the tax rate of taxable estates. In 2019 2570 taxable estate-tax returns were filed and they owed a combined 132 billion. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation.

President biden has proposed major changes to the federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if. 2 CRS Report 95 -416 The Federal Estate Gift and Generation Skipping Transfer Taxes by Emily M. Estates and non-grantor trusts would also be subject to a 3 tax surcharge on modified adjusted gross income which includes ordinary and capital gains income over 100000.

On September 13 the House Ways and Means Committee made public its proposed tax plan the revenue from which would fund President Bidens Build Back Better spending package. People who have large estates and who want to undertake planning to reduce their federal estate tax should do so before the end of 2021 in order to take advantage of the current 117 million gift tax exemption amount which will be reduced to 1 million under the new law. 31 2025 and decrease to approximately 55 million per person.

President biden has proposed major changes to the federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by congress or a later effective date such as beginning january 1. Estate and Gift Taxation In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. This proposed legislation would impact among other things estate gift and generation-skipping transfer tax exemptions valuation discounts and grantor trust rules.

Note that both of these amounts are annually indexed for inflation. We dont make judgments or prescribe specific policies. A surcharge of 5 has been proposed for adjusted gross income AGI in excess of 10 million 200000 for trusts estates and an additional tax of 3 of AGI in excess of 25 million 500000 for trusts estates.

What Is Expected To Change. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. The provision is that the increased exemption amount of 10000000 will revert back to 5000000 after December 31 2025.

Under a Senate Bill introduced by US. See what makes us different. Decrease of Estate and Gift Tax Exemption The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for.

Proposed Changes to Federal Estate Tax. The top federal capital gains tax rate would also increase to 25. An elimination in the step-up in basis at death which had been widely discussed as.

Any modification to the federal estate tax rate. The proposed adjustment to the sunset provision from 2025 to 2021 would reduce the 117 million lifetime gift tax exemption to 5 million. Death Tax Repeal Act of 2021 Congressgov.

Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption would drop to 35 million from the current 117 million level for an individual and 7 million from the current 234 million level for a married couple. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both. Capital gains tax would be increased from 20 to 396 for all income over 1000000.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is Estate Tax And Inheritance Tax In Canada

Estate Tax Definition Federal Estate Tax Taxedu

New Estate And Gift Tax Laws For 2022 Youtube

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Where Not To Die In 2022 The Greediest Death Tax States

Time To Change Your Estate Plan Again

Eight Things You Need To Know About The Death Tax Before You Die

How Canadian Inheritance Tax Laws Work Wowa Ca

How Do State Estate And Inheritance Taxes Work Tax Policy Center

South Carolina Estate Tax Everything You Need To Know Smartasset